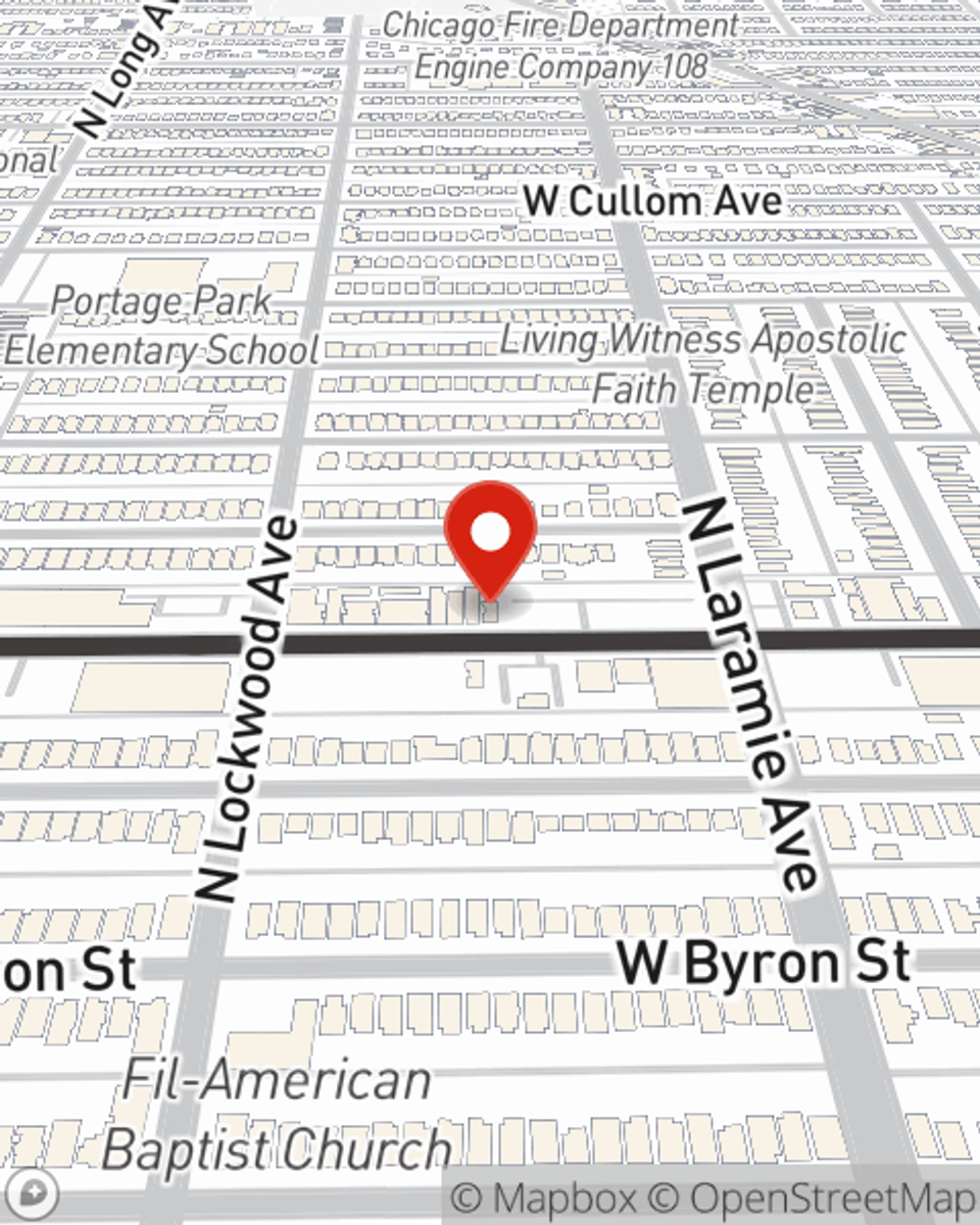

Life Insurance in and around Chicago

Protection for those you care about

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

Protect Those You Love Most

The standard cost of funerals in this country is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for the people you love to meet that need as they grieve. That's where Life insurance with State Farm comes in. Having the right coverage can help your loved ones pay for burial costs and not experience financial hardship.

Protection for those you care about

Now is the right time to think about life insurance

Why Chicago Chooses State Farm

You’ll get that and more with State Farm life insurance. State Farm has terrific policy choices to keep those you love safe with a policy that’s adjusted to accommodate your specific needs. Thankfully you won’t have to figure that out on your own. With solid values and terrific customer service, State Farm Agent Dan Ray walks you through every step to create a policy that protects your loved ones and everything you’ve planned for them.

Simply call or email State Farm agent Dan Ray's office today to see how the State Farm brand can help cover your loved ones.

Have More Questions About Life Insurance?

Call Dan at (773) 777-8277 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Simple Insights®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.